10 Retirement Planning Tips You’ll Need to Plan Your Future

Many of us have been asked the “are you planning for retirement” question, and we could barely utter a word. Realistically, retirement planning is so far off our radars that it’s difficult to give it much thought. After all, we’ve got places to visit, a house to pay for, and perhaps a family to take care of. Understand, however, that even the most careful plans can fall apart due to unforeseen circumstances: an unexpected accident, a lengthy illness, or an employer that goes bankrupt.

Hence, giving retirement some brain space today can pay off big time in the future. Sure, the planning part takes time, knowledge, and tools, but you can do it. This retirement planning guide is full of tips that you can apply to achieve a worry-free retired life.

10 Best Ways to Prepare for Retirement

1. Start Saving Right Away

Especially if you’re just beginning to put money aside for retirement planning, save and invest as much as you can now. Allow compound interest (the ability of your savings to generate earnings) to work in your favor. The sooner you start, the more money you’ll have in retirement.

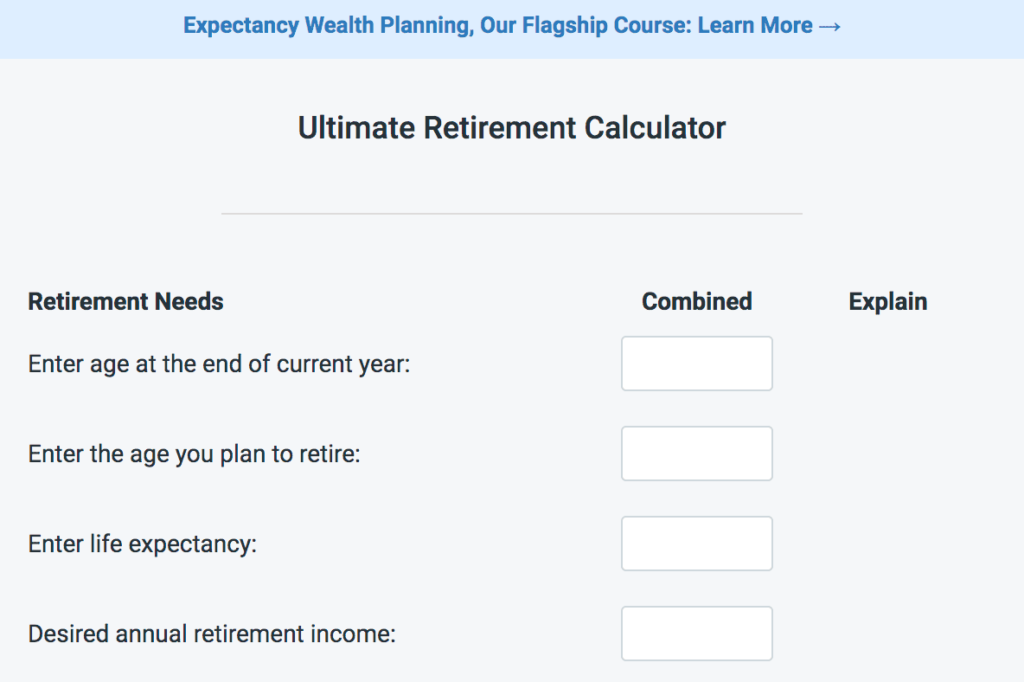

How much should you save for retirement? You can calculate this by using a retirement planning calculator such as Financial Mentor’s Ultimate Retirement Calculator. By entering your age, life expectancy, expected retirement age, desired annual retirement income, and the estimated average yearly inflation rate, the tool will calculate how much you should save each month for achieving your retirement income goal.

2. Leverage Your Company’s Retirement Savings Plan

If you’re working full-time and your company offers a retirement savings plan (such as a 401k or RRSP), then by all means, take advantage! This savings plan can be one of your best retirement planning investments as the majority of employers offer matching programs that can increase the return on your money.

A chunk of your monthly paycheck will go into a retirement account that’s invested in a fund you choose. Your employer will then match your contributions to this investment. If you decide to take up this option and your company consistently matches your contributions, try to contribute enough to gain from full matches. It’s essentially more money from your employer.

Read About – How To Make Money Online

Another advantage of employer-sponsored retirement plans is that you don’t need to pay any tax on your contributions. Plus, all of the growth over time is protected from taxes as well.

3. Find Out If Your Employer Offers A Pension Plan

If the company you work for offers a pension plan, check to see if you’re eligible for coverage and the benefits you’ll get under the plan. Also, get in touch with former employers to learn what pension benefits you have incurred and how they can be applied to your retirement account. Additionally, you may be entitled to benefits from a spouse’s pension plan, so get in touch with his or her employer, as well.

The benefit of activating a pension plan is that you’ll get a guaranteed income upon retirement regardless of how your investment performs, which isn’t possible with employer-matching retirement plans. However, you may not have a say in the investment portfolio; pension plans are usually managed on your behalf by the employer.

4. Get Creative to Save More for Retirement

If you’re in your 30s or 40s, chances are you’re living on a tight budget, which means it’s easy to turn a blind eye to retirement planning. But don’t make that mistake because, with a little motivation and creativity, you can save extra money to put away in your retirement account.

If you don’t have kids or debt, you may have more flexibility and opportunities than you realize. Could you consider renting out a room in your two-bedroom apartment? How about reliving your garden plowing glory days? You could even earn a passive income by driving for Lyft, becoming a tutor, or participating in medical research. When you finally retire, you’ll enjoy looking back at the lengths you went to achieve a comfortable standard of living.

5. Build an Emergency Fund

People’s lack of emergency savings is a longtime retirement enemy. An emergency fund provides a cushion to retirement planning by setting aside funds for unforeseen expenses. Because it exists separately from a retirement account, you’re able to cover an emergency without touching your retirement savings.

The best way to build an emergency fund is to put extra cash into an independent savings account. Put any raise, bonus, or tax refund you receive into savings rather than spending it. Also, tap into this fund only when you have an emergency like a healthcare bill. Otherwise, let your emergency fund grow and continue to help with your retirement planning.

6. Delay Receiving Social Security

This is a big one. Many people start taking Social Security in their early 60s, which is when you can first opt to receive these benefits. However, doing so can negatively affect your retirement planning. That’s because your monthly payout will be 25-30 percent less than what you’ll get by waiting until your FRA (full retirement age).

A better approach is to get your Social Security benefits when you reach your FRA (or at least, a few years after you’re first entitled to receive them). Because market interest rates are quite low nowadays, letting the government keep your money will provide a higher return (a guaranteed 8 percent in the US) than what you would receive from most fixed-income investments.

Let’s simplify this further: Imagine that at age 62, you’re entitled to an annual Social Security benefit of $15,000. If you wait a full year to claim it, you’ll give up on $15,000 in the first year, but at age 63, you’ll get an annual benefit of $16,200, or 8% more – a sum that, for your information, is adjusted for inflation each year.

7. Consider Long-Term Health Insurance

When it comes to retirement planning, it’s easy to assume that your expenses will go down in the latter years of your life. While that’s true to some extent, there’s one expense you need to watch out for: healthcare. While national health insurance programs like Medicare help stabilize healthcare costs for retirees, they do not pay for things like custodial care.

That’s where having long-term health insurance can make a difference. Most long-term health policies start paying out once you’re eligible for benefits and until you reach the lifetime maximum. Eligible costs typically include assistance with ADLs (or activities of daily living), such as bathing and eating. And, if you require residential care at some point, most policies would also help pay for board and room. Therefore, it can be a good idea to integrate long-term health insurance into your retirement planning.

8. Reduce Your Housing Expenses

If you have substantial equity in your home, you already have a pre-existing source to use for retirement planning. One possibility is to rent out your place and move to a less expensive location. Regardless of whether you own a home or not, shifting to a less expensive area is a sure shot way to stretch your retirement savings further.

You could also consider the option of a reverse mortgage, which allows you to continue residing in your home while getting monthly income. This additional earning can be used to grow an emergency fund, meet healthcare needs, and help keep retirement contributions on track.

9. Clear Your Debt (In a Strategic Way)

You want to save for retirement, but you’re still receiving bills each month for old debts. Rather than cursing yourself and giving up, build a plan to get rid of your dues. For example, you can pay a little more than the monthly minimum on student loans, your mortgage, and high-interest credit cards. Use some of your personal savings to pay off debt and keep doing it month after month until you can pursue debt-free retirement planning.

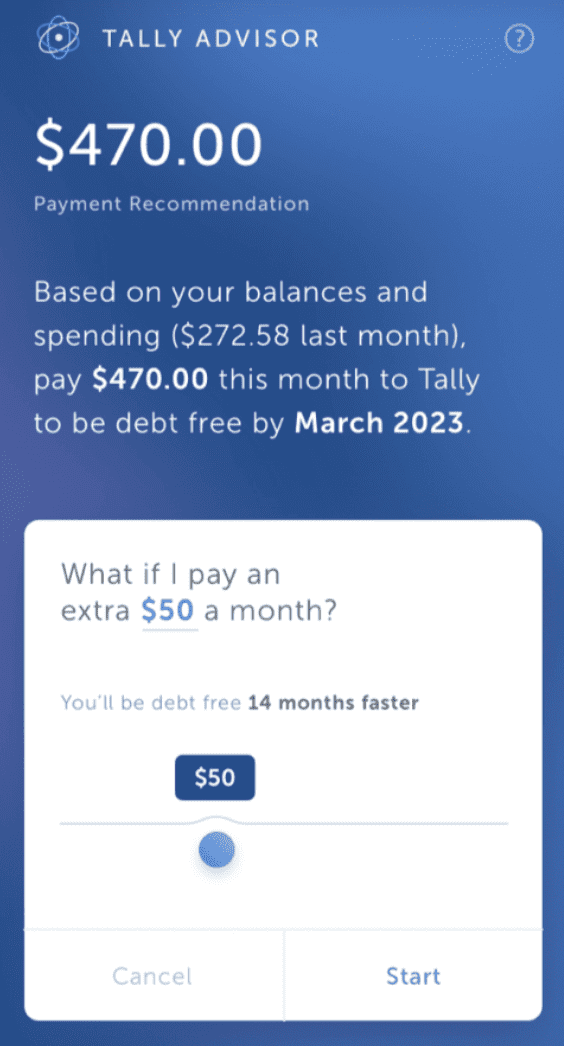

One way to stick with a debt repayment plan is to automate your payments, so you can quickly reach your financial goals. For those with a smartphone, this can be done with the help of Tally. As an automated debt manager, Tally makes it easy to manage your debt, save money, and pay down your balances faster.

10. Diversify Your Investments

Spreading your investments among a range of assets means a better chance of reward in the long run. To increase potential income and reduce volatility, consider investing in things you can control. For example, investing in a website and selling it when you’re nearing your retirement age (or when it starts making a few grand) can give you a healthy return on your investment.

Generally, traditional investments like bonds offer the lowest return compared to other investments. So, regardless of whether you’re further from or close to retirement age, consider investing in high-return businesses you could. Online businesses are much easier to control and grow, and you can even keep them if you wish to stay active in your post-retirement years.

Retirement Planning Mistakes to Avoid

Part of retirement planning involves avoiding the common mistakes people make. So, once you’ve made an effort to save and invest, keep the following mistakes in mind to ensure your efforts lead to a positive outcome.

1. Withdrawing from Retirement Funds

Although buying a car or losing your job may seem like valid reasons to withdraw early, you’re only damaging your financial future if you do. A better option is to trim down on your lifestyle (such as by using public transport) and invest in an asset that makes you enough money to retire happily.

2. Neglecting Inflation

Another retirement planning mistake is to overlook inflation. That bag of potatoes will likely cost 2-3x more in a few decades when you retire. Despite a relatively mild inflation rate over the past decade, the cost of living has more than doubled. So when you’re planning for retirement, you want to ensure that your savings will outpace inflation, or at least help maintain your purchasing power.

3. Taking Debt Lightly

It’s relatively easy to run up debt, but let’s not forget that a heavy debt burden can take a toll on your retirement planning. Adopt wise spending habits – only spend what you can afford to purchase rather than buying things on credit – at an early age. This advice can save you a world of financial pain when you call it quits on your career.

4. Getting Out After a Market Crash

When the market falls, it’s tempting to liquidate the investments in your retirement portfolio and keep the proceeds in cash. However, this will prevent you from realizing the potential gains if the market turns around. So, instead of reacting to short-term changes, consider playing the long game by holding a strategic mix of investment vehicles, such as bonds, stocks, and CDs (certificate of deposits).

5. Having A Conservative Approach to Investing

A good investment portfolio may help you beat inflation, but a sustainable business is what will deliver the best long-term returns. And not having a business means that, unless you don’t want a safety net, you could end up outliving your money. That’s why investing time, effort, and money in acquiring and selling a business is a crucial aspect of retirement planning.

6. Not Revisiting the Retirement Plan

Your life circumstances and financial situation are unlikely to remain the same, which is why it’s crucial to revisit your retirement plan once a year. Doing this will enable you to keep up with market changes and ensure you’re balancing your investments according to your retirement goals.

Conclusion

Retirement planning is a gradual process that requires consistency and attention to detail. Start small with investments and then branch out once you have a fair amount of personal savings. When you start branching out, first do your research and when you spot an opportunity, seize it by investing part of your money. As you learn, the amount can increase. Ultimately, a solid plan will let you take charge of your future as you look forward to entering those golden years.